The stock market had a very good week with the falling wedge on the Ft100 breaking upwards as anticipated. The Oil price has surged by two thirds since the January lows. This helps the markets directly by increasing the share price of many counters and also indirectly by taking the heat off junk bonds issued to the junior oil companies and frackers. In the last year 12 oil companies with liabilities of greater than 500 million dollars have thrown in the towel. The large US banks reported large provisions for bad, oil related debt, in their first quarter reports.

Also a driver of the market has been the first few of the quarterly earnings reports. Both Alcoa and JP Morgan reported reduced earnings but these were higher than expected by the market. This, some decent data from China for a change, Oil and the general dovish note from the FED, produced the “Green Lights” we saw on the home page of VectorVest.

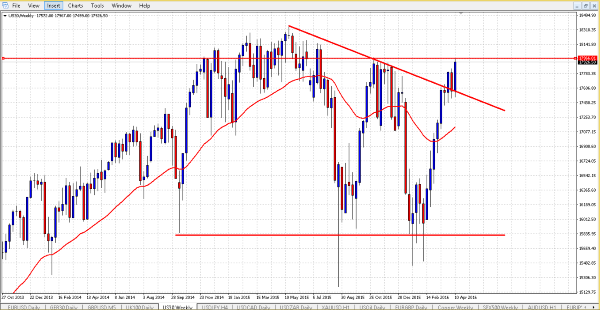

The Dow 30 has broken and kissed the trendline defining the highs of the market high last April and the high at the end of 2015. This is a very positive break with the market camped as I write at highs of December 2015. My chartists mind sees this as large double or even treble bottom. If you draw a horizontal support line through the lows of October 2014, August 2015 and the lows of mid-February 2016, the pattern is easy to spot. It’s shown below.

Conventional charting suggests that when the high between the lows is exceeded a move is probable. The target of this move would be the vertical distance between support and the high of last December. Without getting a slide rule out, that’s a move of 2000 points on the Dow. A definite break of the highs of last December is needed to confirm this move.

The SP500 has been strong but not as strong as the Dow 30. The 500 share index still hasn’t broken the trendline which connects the highs of April 2015 and the highs just before Christmas last year. As I write the high of this week is defined by that trendline.

Over the weekend there is an important Middle East conference on oil production levels. This will be critical for the stock market in the week ahead.

[Join David for his live webinar this week at Round-the-Clock-Trader at 9am BST – ‘Precise Market Timing with VectorVest’ – click here to register]

JD Sports reported excellent results. The City was expecting good numbers but they upstaged those. The share has broken out of an ascending triangle pattern and with a decent market looks set for more. Victoria and Dart are performing well but like the market look much overbought in the short term. A pullback in Dart to the last old high of 600 is probable so all reading, who are holding the stock, need to ponder on that. There is no right and wrong save the exit rules that are in your trading plan.

My building shares are under pressure with board room ructions causing Persimmons to be the week’s poorest performer. It’s still on a hold recommendation and I will get rid of it should that change to sell. I took a good dividend from the share so not unhappy. Builders normally tread water between April and October each year.

I have high hopes for Trifast. The share has been pushing on the highs of an ascending triangle for the past few weeks and sooner or later I feel it will break and move much higher. The share is highly illiquid so please bear that in mind. Illiquid share are a little like marriage. Easy to get in and very expensive to exit.

The DEW market timing system remains on a BUY signal and I will sit until this changes. If the Dow and SP500 breaks the technical levels discussed above then be prepared for a very pleasant ride. They come when we least expect them. It’s hard to believe that its only two months since the doom, gloom and desperation of Mid-February.

I will continue to trade the market and NOT the forecast.

David Paul

April 15th 2016

Join David for his live webinar this week at Round-the-Clock-Trader at 9am BST – ‘Precise Market Timing with VectorVest’ – click here to register

Try VectorVest – click here

Be the first to comment on "A Great week and another Positive Technical Pattern ahead."