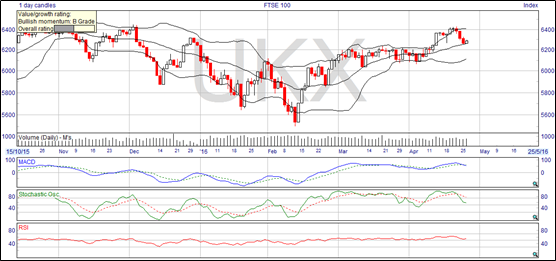

This week we find the FTSE 100 trading around 100 points lower than last week when I last sent my analysis to you. It seems that the London index wasn’t capable to hold on its previous gains and it’s kind of natural to see a mild correction after a really impressive rally. However what really interests us at this point is what to expect next and how to trade the FTSE 100 this week.

[Join Alpesh for a free live online trading webinar this week! – click here]

It is useful that I write this analysis to you today just a few hours ahead of the key event of this week which is no other than the Fed meeting on monetary policy and interest rates. We know beforehand that the Fed is in no place to raise rates today but what is more important is their forward guidance. This becomes even more important as there is no meeting next month and their next scheduled one is on June.

So today’s meeting and the accompanying statement that will come along the rates decision will act as guidance for the next 2 months and there are still voices out there that believe that a June rate hike is still a possibility. So given the increased importance of the meeting we expect the Dollar and the global stock markets to react to the tone that will come out of the meeting.

Expectations are set for the Fed to remain cautious and not hint towards a rate hike in the next couple of months given the recent deterioration of data in the domestic market of the States. Such a development will of course offer renewed support to the stock markets and the FTSE 100 is expected to benefit on the back of it. In that case my trigger lies above the 6,300 points’ level and my targets extend to the 6,330 and 6,400 points for the next few sessions.

In the opposite case that the Fed officials surprise us and disregard the recent string of bearish data from the US and instead focus on the positive developments abroad then the FTSE might extend its correction to the downside and the 6,150 points’ area is my short-to-medium term target. In any case though we need to be extra cautious in such a scenario as the broader bias for the stock markets is bullish so a quick reaction is advised.

[Join Alpesh for a free live online trading webinar this week! – click here]

If you want daily trade signals on the FTSE 100 and the Euro, the Pound, Gold and more Forex, Stock Indices and Commodities instruments I am recommending my Sentinel Signals report that has an impressive performance. You can find more information on Sentinel Signals by clicking on this link.

Be the first to comment on "The FTSE’s outlook hinges on the Fed meeting and their forward guidance"