We all know trading as a concept is simple, (buy low, sell high) but in practice is pretty difficult. The reason it’s difficult is because it is going against our pre wired response mechanisms to dealing with dangerous situations. So a great deal of un-learning has to take place in order to create a trader mindset.

Depending on the individual, traders will experience a whole host of different trading scenarios before becoming successful. Some seem to transition from no profit to profit quite easily whereas others make all kinds of mistakes before they learn the right path.

Personally, my journey started with greed which is never a good path to follow. A trader who hasn’t controlled this emotion is more likely to over-leverage and over trade in their quest to making money as quickly as possible.

I’ll give you another example. A trader I know has pretty much made every mistake in the book. He’s over-traded to the extent that in a single day once lost 30% of his account. He has revenge traded too in that desperate fight to try and make back prior losses. He has also done the obvious one of doubling up in order to try and make back prior losses.

Although he’s made all these mistakes, he has always recognised his problem after and worked hard to rectify it. Many traders would have simply given up after all the trader errors this gentleman has made and yet something has driven him on to keep trying. A while ago I spoke with this trader and said he needed to focus on just one type of trading style which he went away and duly did. He occasionally reported in that his trading had improved dramatically. By focussing, he stopped trying to chase the market and started letting it come to him.

He became more relaxed about his trading in general whereas previously he was always fighting the tape. So I was really pleased to hear he had put in a double digit gain last month on the back of all this hard work. Although we can’t always see the finish line when we are in the thick of it, this trader proves that if you have that stubbornness to not quit, your trading does improve as your experience does….

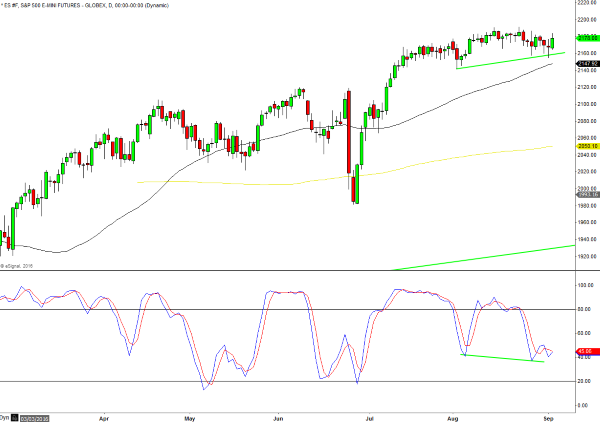

Moving over to the markets, I’m going to move away from the currencies for this week. I’ve been looking for the S&P 500 to move higher out of this summer consolidation and I believe it could now be close to breaking out again. The markets have shrugged of Yellen’s remarks a week ago and the NFP figures have helped the indices rally on Friday. Added to that, looking at the chart there’s been a hidden divergence on the stochastic indicator. This occurs when price makes a higher low but the stochastic becomes more oversold. So unless last week’s low is broken, I see the next move as a continuation to break to new highs for the S&P.

Charlie Burton

Ezeetrader

Click here for 2 free days in the Live Trading Room at Ezeetrader with Charlie

Be the first to comment on "A stubbornness to succeed?"